Textbook and Resource Allowance (TRA) procedure

Audience

- State and non-state schools in Queensland who enrol eligible (see overview, below) students.

- Parents of students eligible to receive the Textbook and Resource Allowance (TRA).

Purpose

The Textbook and Resource Allowance is a State Government allowance that provides financial assistance to parents (see definition) of full and part-time secondary students to offset the cost of education.

Overview

The Department of Education (the department) pays the allowance to schools on behalf of parents of students attending:

- years 7-12 at approved state and non-state schools (excluding hospital schools, youth detention education and training centres, students enrolled in part-time distance education at non-state schools and full fee-paying international and temporary resident students)

- approved special schools studying a modified curriculum at the year level equivalent of 7-12.

Parents of children in registered home education (years 7-12 or equivalent) will receive this payment directly.

The department administers the TRA with a commitment to equity and accessibility, ensuring it is delivered in a manner compatible with human rights.

Responsibilities

Manager and Assistant Manager of the Home Education Unit

- Facilitate payment of TRA to parents of children registered for home education, age equivalent to Years 7‑12.

Schools of Distance Education and Milpera State High School

- Ensure accurate information is reported to Finance Branch for payment of appropriations.

Finance Branch

- Pay TRA to schools based on student enrolment data in accordance with the payment schedule.

State School Principals

- Maintain accurate enrolment data.

- Inform parents eligible to receive the TRA of the options for how this allowance can be attributed to school costs or received directly, by:

- reducing participation fees for the school’s Student Resource Scheme (SRS) (see also Student Resource Scheme procedure)

- credit to the student’s account

- direct funds transfer to the parent.

- Ensure that the TRA income equals the TRA expenditure area/s of the budget. See Student Resource Scheme (SRS) Administration Guide (DoE employees only) for detailed information.

Non-State School Principals

- Provide accurate enrolment data to the department.

- Determine, in consultation with parents, how these funds will be applied to support student resourcing.

- Acknowledge the Government’s TRA contribution when communicating with parents about how these funds are applied.

Process

1. Finance Branch pays TRA appropriation to schools

TRA payments are made according to the appropriation profile for state schools (including Schools of Distance Education and Milpera State High School) and non-state schools.

2. Parents of eligible registered home education children

Parents will be contacted by the Home Education Unit in March of each year to organise the payment.

3. Schools pass TRA on to parents

Non-state schools

- Non-state schools will either:

- forward the TRA to parents either as a direct payment or as a reduction in tuition fees; or

- expend the TRA for the benefit of those students whose parents have elected for it to be applied to a school offered option (e.g. textbook hire scheme).

- Parents of students who depart the school during the year are entitled to a pro-rata refund of the TRA, which should be calculated on the basis of a 40-week school year.

State schools

- State schools that offer a SRS (see also, Student Resource Scheme procedure) will apply the TRA as a reduction to the annual SRS participation fee, and clearly demonstrate this reduction to parents. Parents of students eligible to receive the TRA, who have informed the school that they do not wish to participate in the SRS will receive the TRA either as a credit to the student’s account or as a direct payment from the school after the February census data collection date.

- Parents who wish to receive this payment as a direct credit to their account can inform the school via completion of the Participation Agreement Form (for schools that run a SRS), and if eligible complete the school request for refund (DoE employees only) form.

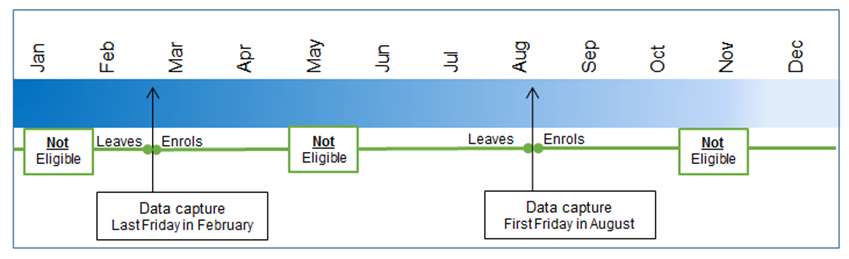

- The TRA that the school receives is based upon a schedule of payments. This affects a student’s eligibility to receive the TRA. Please see the table below to determine eligibility for claiming the TRA based on enrolment dates.

Students who enrol and leave the school between data capture dates are NOT eligible for the TRA.

Students enrolled at the school when data capture occurs are eligible for the TRA.

Image

1

TRA eligibility

- Parents of eligible students who attend school for part of the school year will be eligible for a pro-rata amount of the annual allowance.

- The SRS refund calculator (DoE employees only) can help state schools to determine the correct pro‑rata amount.

- Guidance for state schools on recording and reporting TRA income and expenditure is included in the Student Resource Scheme (SRS) Administration Guide.

Definitions

|

Term

|

Definition

|

|

Full fee paying International students

|

Students who are in Australia on a 500 visa (or previous 571 visa) and who are paying full fees for their education in Australia.

|

|

Full fee paying Temporary Resident students

|

Students other than those on a 500 student visa, who are a temporary visa holder.

|

|

Allowance

|

The TRA is not an employment related allowance and is not subject to income tax (no PAYG withholding and not reportable to Australian Taxation Office).

|

|

Parent

|

Under the

Education (General Provisions) Act 2006 (Qld) (EGPA), s.10 parent is defined as –

- the child’s mother

- the child’s father

- a person who exercises parental responsibility for the child.

For the purposes of this procedure a parent also means carer, guardian and independent student.

Section 10 of the EGPA provides further information regarding the definition of a parent.

|

Legislation

Delegations/Authorisations

Other resources

Superseded versions

Previous seven years shown. Minor version updates not included.

5.0 Textbook and Resource Allowance (TRA)

4.0 Textbook and Resource Allowance (FNM-PR-008)

3.0 Textbook and Resource Allowance (FNM-PR-008)